Payroll Processing Services in India

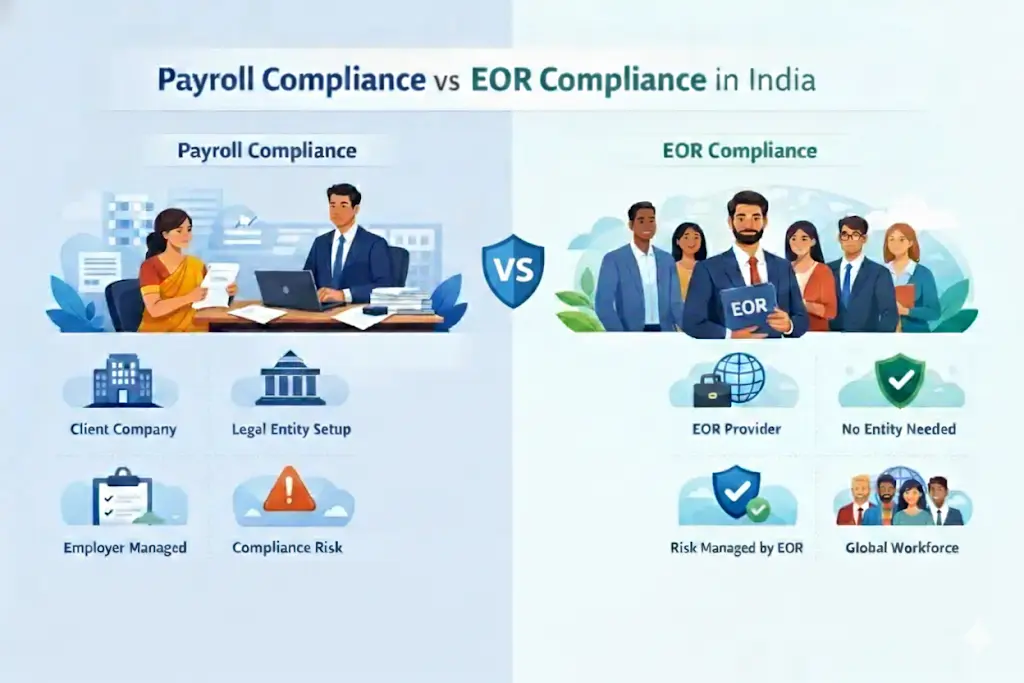

Payroll Processing Services in India: Benefits, Process and Best Practices for Businesses Payroll management is one of the most essential yet complex functions within an organization, from calculating salaries and handling tax deductions, to complying with Indian labor laws, payroll requires accuracy, timeliness and constant monitoring for regulatory updates – any small mistakes could cause employee discontentment, financial penalties and compliance risks that threaten business continuity. As businesses expand and their employee structures change, managing payroll in-house becomes increasingly challenging. That is why so many organizations rely on professional Payroll Processing Services in India for salary administration purposes while adhering to all legal compliance issues. At Innothrive Solutions – Global Payroll we have comprehensive payroll solutions designed to streamline payroll operations, increase compliance accuracy and support business efficiency. On this blog we explore all aspects of payroll processing as well as its key benefits and how effective management should take place. What Are Payroll Processing Services? Payroll processing services manage all activities related to employee compensation in an accurate and compliant fashion, typically including: Salary Calculations, Tax Deductions (TDS), Statutory Compliances (PF, ESI, PT & LWF). Bonus and incentive management. Final settlement processing. By outsourcing payroll to an experienced provider, businesses can reduce administrative burdens while simultaneously increasing accuracy and regulatory compliance. Key Components of Payroll Processing in India Payroll management in India necessitates careful attention to multiple components: 1. Employee Data Management System Maintain accurate employee records such as salary structure, tax declarations, bank details and attendance data. 2. Attendance and Leave Tracking Calculating gross salary, allowances, reimbursements, bonuses and deductions. 3. Salary Computation Monitoring work hours, overtime work hours, paid leave time off and unpaid leave will enable accurate salary calculations. 4. Tax and Statutory Deductions Deducting Tax Deduction and Settlement, Provident Fund (PF), Employee State Insurance (ESI), Professional Tax and other statutory contributions as required. 5. Payslip Generation and Disbursement of Salary Payments Distribute clear salary statements and ensure timely transfers. 6. Filing and Reporting Compliance Documents and Information Preparing and submitting statutory reports to relevant authorities to avoid penalties. Step-by-Step Payroll Processing Method (Revised) An effective payroll system follows a structured procedure: Employee Data Collection – Collecting salary structures, attendance records and tax declarations of employees is necessary in order to assess employee data correctly and in an accurate fashion. Validate Input – Verifying attendance, bonuses, reimbursements and deductions. Salary Calculation – Accurately calculate both gross and net pay with this easy calculator. Tax & Compliance Deductions – Applying statutory deductions according to current legislation. Payslip Generation – Empower employees with transparent salary breakdowns. Salary Disbursement – Moving the salaries directly into employees’ bank accounts. Compliance Reporting – Submitting returns and maintaining payroll documents. Simplify payroll management with expert compliance support Call Now Benefits of Payroll Processing Services in India Professional payroll services offer several significant advantages: 1. Increased Accuracy Automated payroll systems help increase accuracy by eliminating manual errors when it comes to salary calculations and tax deductions. 2. Efficiency both in time and cost Outsourcing payroll reduces administrative workload while eliminating the necessity to retain in-house expertise on payroll matters. 3. Compliance Payroll experts We ensure compliance with Indian tax and labor regulations as well as any statutory requirements. 4. Increased Data Security Advanced payroll systems offer enhanced protection of employee information via access controls and encryption technologies. 5. Increase Employee Satisfaction Payroll payments that arrive promptly and accurately build employee trust and organizational credibility. Why Businesses in India Require Professional Payroll Services India boasts an ever-evolving regulatory structure. Businesses operating within its boundaries must abide by: Income Tax regulations with Provident Fund contributions. Employer State Insurance requirements exist. Professional Tax regulations. Labor law compliances. Failure to abide by labor law requirements can incur both fines and legal complications for businesses. Partnering with Innothrive Solutions – The Global Payroll ensures their client remains compliant, so that growth-minded managers can focus on core operations rather than stay on top of compliance issues. Best Practices for Efficient Payroll Management Businesses aiming for effective payroll systems should follow these best practices: Implement Payroll Automation Solutions today Utilize reliable payroll software to reduce manual intervention and enhance efficiency. Stay Up to Date on Compliance Changes Regularly stay current with changes to tax laws and labor regulations. Standardize Payroll Policies Maintain clear payroll policies to ensure consistency and transparency in payment practices. Hold Regular Audits Regular payroll audits help identify discrepancies and improve accuracy. Ensuring Reliable Data Security Solutions Safeguard employee data with secure systems and restricted access controls. How to Select an Appropriate Payroll Service Provider (Example). Before selecting a payroll partner, it’s important to: Industry knowledge, Compliance expertise, Technology capabilities and automation capabilities. Scalability in Data Security Standards.Provide responsive customer support. Innothrive Solutions – Global Payroll offers reliable and secure payroll solutions tailored specifically for business. Their advanced payroll technology combines with regulatory knowledge for maximum performance. Future Trends in Payroll Processing Services Payroll services have transformed over time thanks to technological innovations. Some notable emerging trends for payroll include: Cloud-based payroll systems (CPPS) AI-driven payroll automation system Integrated HR and payroll platforms Real-time monitoring for compliance purposes Employ self-service portals These innovations are revolutionizing payroll management into an efficient and strategic business function. Effective payroll administration is essential to business stability, employee happiness and regulatory compliance. With increasingly complex workforce needs and evolving labor laws in India, professional Payroll Processing Services have become more of an imperative than an option. By teaming with experienced providers such as Innothrive Solutions – The Global Payroll, businesses can streamline payroll operations while remaining compliant and maintaining sustainable growth strategies within an aggressive market environment. Partner with us for accurate, secure payroll processing Call Now FAQs What are payroll processing services in India? Payroll processing services manage employee salary calculations, tax deductions, statutory compliance, payslip generation, and salary disbursement accurately and on time. Why should businesses outsource payroll in India? Outsourcing payroll reduces compliance risks, improves accuracy, saves time, and ensures adherence to Indian tax laws and labor regulations.

Payroll Processing Services in India Read More »