New Labour Codes in India – Strategic Transformation for Corporates and ISPL’s End-to-End Support Framework

Introduction

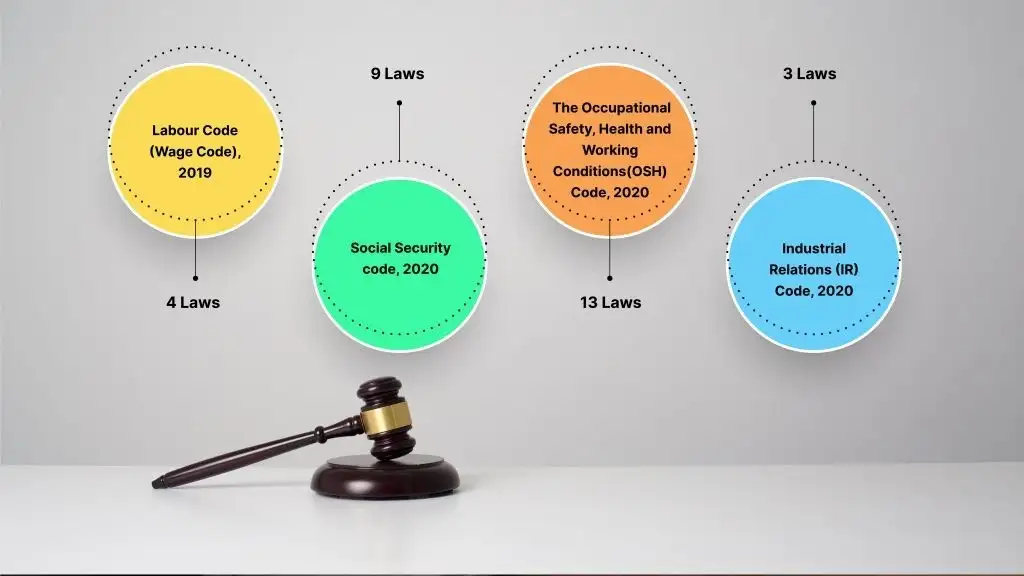

- India has consolidated 29 labour legislations into four integrated Labour Codes, marking an unprecedented regulatory transformation.

- The reforms deliver standardisation, transparency, digital compliance and an expanded scope of workforce protections.

- For corporates and global enterprises, this shift requires strategic planning across legal, HR, finance and operations—not mere administrative adjustment.

- Proactive enablement aligns business models with modern regulatory, ESG and workforce expectations.

Overview of the Four Labour Codes

Code on Wages

- National floor wage with expanded minimum wage coverage

- Uniform wage definition impacting PF, gratuity, bonus, and benefits

- Strengthened enforcement on timely and fair wage payments

Industrial Relations Code

- Modern dispute resolution frameworks and trade union recognition

- Increased threshold for layoff and closure permissions (100 → 300 workers in specified units)

- Legal recognition of fixed-term employment with proportional benefits

Code on Social Security

- Consolidated PF, ESI, gratuity, maternity and compensation laws

- Expanded coverage to gig and platform workers

- Greater consistency in employer social security obligations

OSH Code (Occupational Safety, Health & Working Conditions)

- Defined working hours, overtime, welfare and facility norms

- Stronger health, hygiene and safety compliance expectations

- Permission for women’s night shifts with mandatory safeguards

Key Implications for Employers

- Direct impact on employment cost due to wage structure re-alignment

- Mandatory restructuring of compensation architecture

- Workforce agility through formalisation of fixed-term and gig models

- High-focus safety and welfare obligations requiring operational upgrades

- Strengthened documentation and HR compliance mandates

- Elevated responsibility for contractor governance and supply-chain compliance

- Tightened monitoring of working hours, register maintenance and digital filings

Critical Changes Every Employer Must Track

- National floor wage becoming the baseline for all wage structures across states

- Revised uniform wage definition influencing PF, gratuity, bonus and other statutory costs

- New overtime and working hour frameworks requiring payroll and shift planning alignment

- Mandatory appointment letters across categories of employees

- Fixed-term employment treated at par with permanent employees for benefits

- Government approval threshold for layoffs and closures expanded in specified units

- Single-licence provisions for contract labour operations across states

- Gig and platform workforce formally recognised under social security coverage

- Enhanced safety conditions and infrastructure norms under OSH compliance

- Protection and welfare compliance for women working night shifts

- Requirement for annual medical examinations for certain worker categories

- Digital record-keeping and reduction of multiple registers and formats through integrated systems

Compliance & Business Risks if Organisations Delay

- Statutory penalties and adverse regulatory outcomes

- Litigation relating to wages, classification and workforce management

- Industrial unrest if change communication is mishandled

- Brand and ESG perception risks due to labour governance lapses

- Business continuity challenges from contractor non-compliance

Strategic Priorities for Enterprises

- Comprehensive labour compliance audit and gap alignment

- Rationalisation of basic-to-allowance ratios within compensation structures

- Redrafting of HR Manuals, contracts and Standing Orders

- HRIS and payroll system upgrades for full statutory automation

- Structured contractor compliance assurance mechanisms

- Safety and workplace infrastructure strengthening

- Leadership and workforce communication for smooth transition

ISPL’s Expertise in Navigating Labour Code Transition

| Category | Services |

|---|---|

| Compliance Impact Assessment |

|

| Compensation Architecture & Payroll Re-Engineering |

|

| Documentation and Policy Modernisation |

|

| Contract Labour & Vendor Governance Strengthening |

|

| Workforce Safety & OSH Compliance |

|

| Industrial Relations & Change Management Support |

|

| Governance, Monitoring & ESG Integration |

|

Recommended Transformation Roadmap

- Assessment and gap analysis across all business units

- Policy and compensation realignment for compliance assurance

- Implementation and statutory documentation roll-out

- Training, communication and stakeholder alignment

- Continuous monitoring with audit controls and reporting dashboards

Our End Remarks

- The new Labour Codes offer not only a regulatory compulsion but a strategic opportunity to modernise workforce systems.

- Organisations that act proactively will enhance operational resilience, compliance credibility and talent reputation.

- ISPL ensures not just legal alignment but holistic transformation — enabling organisations to become responsible, competitive and future-ready employers.