Payroll Compliance vs EOR Compliance: What Indian & Global Businesses Need to Know

As companies expand across borders, managing employees compliantly becomes one of the biggest operational challenges. Businesses often face a key decision: should they work with payroll compliance service providers in India or partner with an Employer of Record in India? While both models support workforce management, their compliance responsibilities differ significantly.

This blog explains the difference between Payroll Compliance vs EOR Compliance, helping decision-makers choose the right model based on risk, scalability, and legal responsibility.

Understanding Payroll Compliance

Payroll compliance refers to ensuring that employee salaries, taxes, and statutory benefits are processed in accordance with local labor laws. Businesses that engage payroll compliance service providers in India usually remain the legal employer while outsourcing payroll-related functions.

Experienced service providers, such as Innothrive Solutions – The Global Payroll, support organizations by managing payroll accuracy, statutory filings, and compliance reporting while allowing businesses to retain full control over their workforce.

Key Payroll Compliance Responsibilities

- Accurate salary calculation and disbursement

- Statutory deductions such as PF, ESIC, PT, and TDS

- Monthly and annual payroll filings

- Compliance with Indian labor laws and wage regulations

- Maintaining payroll records and audit support

What Is EOR Compliance?

An Employer of Record in India acts as the legal employer on behalf of a client company. This approach is commonly used by international businesses that want to hire employees in India without establishing a local legal entity.

EOR providers handle end-to-end employment compliance, reducing the administrative and legal burden on client organizations.

Simplify workforce compliance with trusted global payroll experts

Key EOR Compliance Responsibilities

- Drafting compliant employment contracts

- Managing employee onboarding and offboarding

- Handling payroll, taxes, and statutory benefits

- Ensuring adherence to labor and employment laws

- Managing compliance risks and employee-related obligations

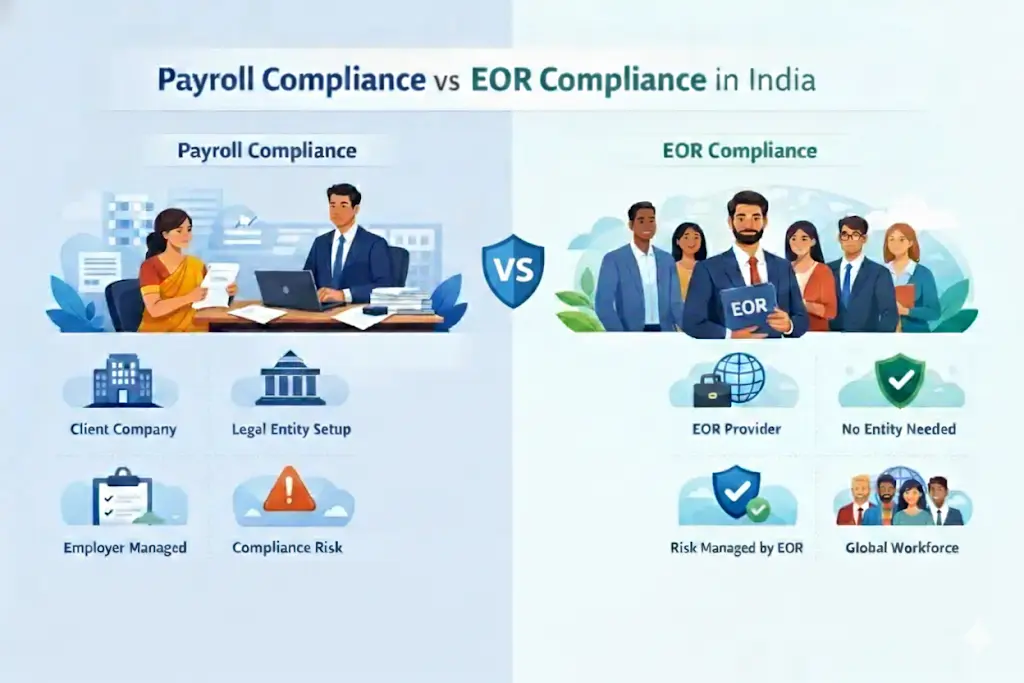

Payroll Compliance vs EOR Compliance: Key Differences

| Aspect | Payroll Compliance | EOR Compliance |

|---|---|---|

| Legal Employer | Client company | EOR provider |

| Compliance Risk | Lies with employer | Managed by EOR |

| Entity Requirement | Mandatory | Not required |

| Employment Contracts | Client-managed | EOR-managed |

| Best For | Established Indian entities | Global expansion & remote hiring |

When Should You Choose Payroll Compliance Services?

Working with payroll compliance service providers in India is ideal when:

• You already have a registered entity in India

• You want control over HR and employment decisions

• You only need support with payroll processing and statutory compliance

• You have internal teams to manage employment-related risks

This model suits businesses seeking operational efficiency while retaining legal ownership.

When Is an Employer of Record the Better Option?

Choosing an Employer of Record in India makes sense when:

• You want to hire quickly without setting up an Indian entity

• You are expanding into India for the first time

• You want to minimize legal and compliance exposure

• You prefer a fully managed employment solution

For many global organizations, EOR compliance offers flexibility, speed, and reduced regulatory risk.

Innothrive Solutions – The Global Payroll

Innothrive Solutions – The Global Payroll supports Indian and global businesses with reliable payroll compliance and Employer of Record (EOR) solutions. With strong expertise in statutory regulations, labor law compliance, and global payroll management, the company helps organizations navigate complex compliance requirements with confidence. Whether a business needs support from payroll compliance service providers in India or a full EOR model for rapid expansion, Innothrive Solutions enables compliant hiring, accurate payroll processing, and risk mitigation while allowing companies to focus on growth and strategic objectives.

Making the Right Compliance Decision

The decision between payroll compliance and EOR compliance depends on your business structure, expansion strategy, and risk tolerance. While payroll compliance focuses on accurate execution, EOR compliance provides complete legal employment management.

Understanding Payroll Compliance vs EOR Compliance enables organizations to select a model that aligns with their growth objectives while ensuring regulatory adherence. With expert guidance from providers like Innothrive Solutions – The Global Payroll, businesses can confidently manage compliance in India and across global markets.