Payroll Outsourcing Companies in India: Pros, Cons & How to Choose the Right Partner

Spreading business across borders brings endless opportunities but also tons of challenges related to payroll management, financial and administrative duties.

Payroll management is one of the most crucial and tough operations for many businesses. It includes complex calculations of salaries or wages, handling tax deductions, benefits, and timely and accurate payments to employees.

To ensure accuracy, businesses hire payroll outsourcing companies in India.

In this guide we'll walk you through payroll outsourcing: how it works, what services should be included, the benefits and challenges.

What Is Payroll Outsourcing?

Payroll outsourcing is an practice where you hand your company's payroll responsibilities to third party payroll experts, rather than managing everything on your own. For global businesses, this is like partnering with a dedicated payroll provider who is going to take care of everything whether it's calculating employee wages and deductions to ensure the compliance with local tax laws and labour regulations across different countries. This allows a company to reduce its administrative burden, ensure less errors, and stay adaptable.

From our years of experience with international organizations, we can say that payroll outsourcing not only limits to the simply handling paperwork. It's a comprehensive service where experts manage every single thing related to payroll- complex calculations, taxes, compliance with local laws, reporting, and securing data handling.

If you want to explore more common challenges that organizations usually face and how we solve them, visit our detailed guide on Payroll Challenges and Solutions, Why Global Businesses Choose Us, And Advantages You'll Get.

What Services Do Payroll Outsourcing Firms in India Provide

When you partner with one of the leading payroll management companies in India, you can get specialized services made to make your administrative tasks easier, more accurate, and fully docile regardless of the country, city, or location your employees work from.

Here's detailed look at the key services provided by the top payroll processing companies in India.

Payroll Computation & Processing

This operation includes precise calculation of employee salaries, wages, bonuses, overtime, deductions, and net pay, ensuring everyone is paid correctly and on time.

Tax Compliance & Filing Support

Handling all the complex TDS calculations, PT, PF, ESI deductions, and ensuring timely statutory filings.Employee Benefits & Reimbursements Management

Managing employee benefits like insurance, retirement benefits, paid time off, and integrating these flawlessly into the payroll process.Salary Disbursement & Direct Deposit Services

Ensuring salary transfer through secure banking integrations and handling multiple currencies for global teams.Employee Self-Service Platforms

Giving online access to employees for viewing pay slips, download tax documents, updating personal details, and managing leave requests-reducing HR workload and improving transparency.Time, Attendance & Leave Tracking

Integrating swipe cards, or digital attendance systems to capture accurate time, attendance, and leave data. Payroll always reflects real-time attendance, reducing administrative workload.On-boarding and Exit Management Assistance

Make the process of adding new hires to payroll, and managing exits easier and ensuring that all the compliance paperwork is handled smoothly.Custom Reporting & Analytics

Generating detailed reports on payroll expenses, tax liabilities, overtime, employee costs, attendance trends, and more. This can help senior leaders to make data-driven decisions and plan budgets more effectively.End-to-End Compliance Management

Proactively monitoring and adapting to changes in labour laws, statutory requirements, and tax regulations to keep your business compliant.

While these services are covering the essentials of payroll services, many global businesses benefit from going a step further. Complete solutions like Global Employee of Records (EOR) and Professional Employer Organization (PEO) can simplify the entire spectrum of HR, compliance, and employee records management.

If you’re not aware about how EOR services can be beneficial for your organization, then explore our article on Top 10 Reasons to Use EOR Services in India for Your Global Business

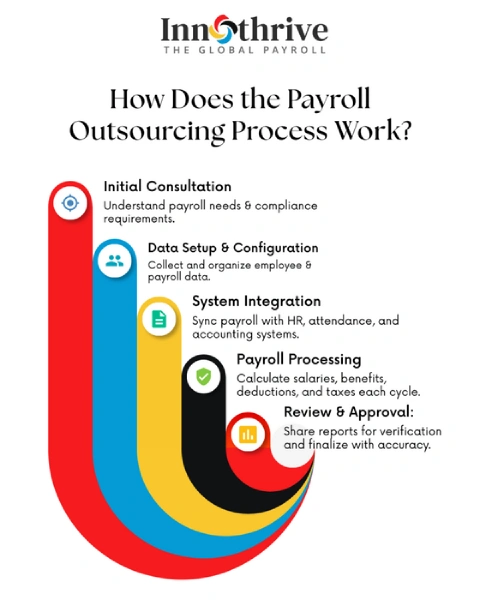

How Does the Payroll Outsourcing Process Work?

Payroll outsourcing process follows a structured workflow which is designed to simplify complex business operations. This is how payroll outsourcing companies in India typically handle the process for global businesses.

Initial Consultation & Requirement Assessment

Understanding organization's payroll needs, employee structure, and compliance requirements comes first. It helps to define the exact scope of work that ensures that both teams are aligned from the start.Data Gathering, System Setup & Configuration

Collecting all the employee and payroll-related data and organize them to match your salary policies and rules.Integration With Existing HR & Accounting Systems

Integrating payroll tools with existing HR platforms like attendance, leave, HRIS, and accounting systems.Regular Payroll Processing

Salaries are processed timely in each cycle based on attendance, benefits, deductions, and legal calculations.Verification, Review & Approval

Payroll reports will be shared with your HR or finance team for checking before finalization. Any required corrections are made, ensuring complete transparency and accuracy.Salary Payments & Statutory Filings

Once approved from HR and Finance team, your employee salaries will be transferred securely, and payslips will be issued.Continuous Support, Audits & Updates

Ongoing support is provided from employee queries, compliance updates, and reporting needs.

Simplify global payroll and stay compliant with our trusted experts.

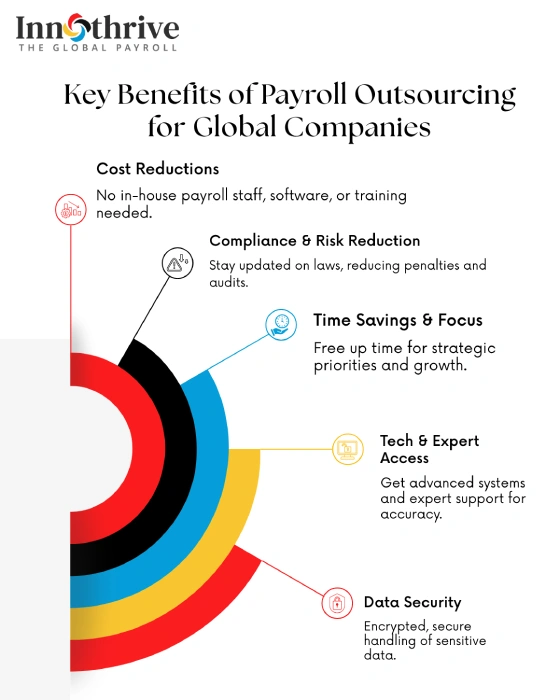

What Are the Key Benefits of Payroll Outsourcing for Global Companies

Outsourcing payroll services has become a prime choice for many international companies that aim to optimize the efficiency, ensuring compliance, and focus on their core business functions.

Here are the key benefits global companies can expect:

Major Cost Reductions

Outsourcing payroll from expert payroll management companies in India eliminates the need of in-house payroll staff, software investments, and ongoing training. You pay only for the service you use, allowing your business to save money and operate more efficiently.Strong Compliance & Lower Regulatory Risks

Payroll providers stay updated on local tax and labour laws to ensure compliance and minimize the penalties, audits across multiple countries.Time Savings & Better Focus on Core Operations

Handling payroll internally is time-consuming and error prone. Outsourcing allows teams to focus on strategic priorities and business growth.Access to Advanced Technologies & Payroll Experts

Payroll outsourcing companies in India offers modern payroll systems and analytical tools for accurate processing.

Enhanced Data Security & Confidential Handling

Sensitive employee information is protected with encryption and secure systems to ensure the confidentiality and less risk of data breaches.

What Challenges Do Global Companies Face When Outsourcing Payroll

Outsourcing payroll services brings a lot of benefits, but it also brings many challenges. After all, understanding the real challenges will help you to make more better decisions.

Here are some of the most common pain points we've seen global companies face when outsourcing the payroll:

Managing Diverse Local Regulations

Every country has its own tax, labour and social security rules, which can change frequently. Payroll management companies in India must navigate these variations carefully to prevent the penalties and ensure full compliance.Reduced Direct Oversight & Control

Outsourcing payroll means a third party handles key processes, limiting day-to-day visibility. Companies may face delays in addressing errors or making urgent adjustments.Data Privacy & Cybersecurity Risks

Payroll involves highly sensitive employee information like salaries and personal details. If not secured properly, this data can be more misused due to data breaches, and regulatory violation.Technology, Integration & Compatibility Issues

Payroll systems should flawlessly integrate with HR and accounting software. Incompatibility or poor integration can cause errors, delays, and duplicate work. Maintaining smooth workflow across multiple platforms requires careful planning and monitoring.Multi-Currency Payments & Varying Payroll Cycles

Global payroll often involves multiple currencies and diverse payment schedules. Errors in conversion or scheduling can create financial discrepancies and employee dissatisfaction.

Why Choose Innothrive Global Payroll as Your Outsourcing Partner

Innothrive Global Payroll offers a complete and reliable payroll outsourcing solution customized for your business operating locally and globally. With expertise in multi-country compliance, advanced technology, and a commitment to accuracy, we ensure that your payroll processes are flawless, secure, and efficient.

Here is what you will receive from Innothrive Global Payroll:

Complete Payroll Management

Innothrive Global Payroll handles the entire payroll lifecycle, from salary calculation and tax deductions to benefits management and employee reporting. Our end-to-end solution reduces the administrative burden, allowing your HR and finance teams to focus on strategic priorities. With our automated processes and dedicated support, we ensure timely and accurate payroll every time.Multi-Country Compliance

Navigating payroll across multiple countries is effortless with our depth knowledge of local labour laws, tax regulations, and reporting requirements. We ensure that your payroll remains fully compliant in every region, significantly reducing the legal risks and potential penalties.

global expertise keeps your organization up to date with regulatory changes, providing peace of mind no matter where your workforce is located.

Zero Error, Zero Delay

We make sure that your payroll is always accurate and on-time. Our advanced technology software monitored by experts handles calculations and validations without any mistakes. With our attentive monitoring and quality checks, your employees receive their salaries on time, building trust and satisfaction across your team.Cost Efficiency Without Compromise

Innothrive Global Payroll delivers payroll services at competitive rates, by optimizing the operational costs without sacrificing accuracy or compliance.

Our smooth process and automation reduce the manual effort and resource expenses. With Global Payroll, you can gain the efficiency, reliability, and peace of mind.

Final Thoughts

Navigating the complexities of payroll processing can be a frustrating task for any organization, especially for the businesses that operate across borders. This is where payroll outsourcing companies in India steps in as a strategic partner.

By partnering with one of the best payroll processing companies in India, like Innothrive Global Payroll, your can get rid of administrative burdens and also gain access to advanced technologies, expert knowledge, and robust compliance.

If you're looking for a way to simplify your payroll operations, partner with Innothrive Global Payroll today and enjoy stress-free, and compliant payroll management.