Why Professional Bookkeeping Outsourcing in India is the Smart Choice for Global Businesses

Bookkeeping is an essential part of any business. Managing financial records, organizing daily financial transactions, maintaining and balancing ledgers, and other operations can be time-consuming and costly. Hence, companies from across the globe are seeking ways to minimize this burden and costs while improving efficiency and focusing on core business functions.

They are now opting for outsourced bookkeeping services in India. Whether it's start-ups, small or medium-sized companies, or large enterprises, everyone is outsourcing bookkeeping to maintain their workflow and increase accuracy.

The Growing Trend of Bookkeeping Outsourcing

Businesses are constantly looking for ways to improve efficiency and save money in today’s dynamic business world.

That’s why outsourcing bookkeeping services in India has become one of the fastest-growing trends in recent years.

What is Professional Outsourcing Bookkeeping?

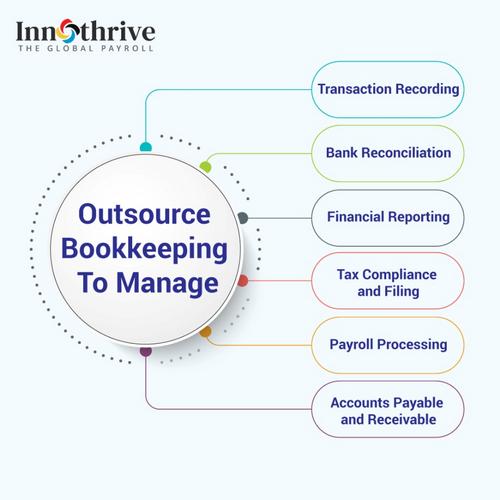

Outsourcing bookkeeping means assigning a company’s financial record-keeping tasks to a third-party service provider. These outsourced services include a range of financial management tasks like:

- Transaction Recording: Documenting every financial transaction of a business, including sales, purchases, receipts, and payments.

- Bank Reconciliation: Comparing a company’s cash book records with its bank statements to ensure that inconsistencies are identified and resolved quickly.

- Financial Reporting: Preparing key reports like balance sheets, income statements, and cash flow statements that offer insight into the company’s financial health.

- Tax Compliance and Filing: Ensuring that sales tax is correctly calculated, collected, and filed with the appropriate government authorities.

- Payroll Processing: Handling employee payroll and ensuring accurate wage calculations, tax deductions, and timely disbursement of salaries.

- Accounts Payable and Receivable: Managing and tracking payments to suppliers and ensuring timely collections from customers.

Key Benefits of Outsourcing Bookkeeping to India

Cost Efficiency

It is one of the most essential reasons to choose outsourced bookkeeping services in India.

- Lower labor costs without compromising quality.

- No stress of hiring, training, or purchasing software licenses.

- Pay only for the services you need, avoiding full-time salaries and benefits.

Access to Skilled Professionals

India has a large talent pool of accounting and finance experts. Professional bookkeeping outsourcing in India ensures that you have access to qualified professionals who are:

- Experienced in handling bookkeeping for various industries like retail, tech, e-commerce, and manufacturing.

- Skilled and trained in the latest accounting software and tools.

Flexibility and Scalability

Outsourcing services make it easier to scale up or down based on your business requirements.

Benefits include:

- Easy adjustment of service levels based on transaction volumes or seasonal demands.

- Access to a wide range of services, from basic bookkeeping and payroll to advanced financial analysis and tax planning.

Focus on Core Business Functions

You save time by outsourcing bookkeeping, which allows you to focus on your core business activities like:

- Revenue-generating activities

- Business development

- Enhancing customer experience

An outsourced bookkeeping expert can handle these tasks for you and allow you to focus on your core business operations and expand your market presence.

Enhanced Data Security and Confidentiality

- Secured cloud-based systems to protect financial records.

- Compliance with international data protection standards like GDPR.

- Confidentiality agreements that ensure your business data remains private and secure.

What to Look for in a Professional Bookkeeping Outsourcing Partner in India

Global Accounting Expertise

When outsourcing your bookkeeping, it’s important to work with experts who have knowledge of both local and international accounting standards.

- Qualified Experts: Look for professionals who have certifications like CPA, CA, ACCA, or CMA, ensuring your bookkeeping is handled by highly trained professionals.

- International Standards Knowledge: Your partner should be well-versed in IFRS, GAAP, and other global accounting norms.

- Cross-Border Experience: They should expertly manage international financial regulations and ensure flawless operations.

- Customized Solutions: They must have experience across various industries to offer bookkeeping that’s customized for your business needs.

Upgrade your financial workflows with expert outsourcing support.

Tax-Smart Bookkeeping

Taxes are complex, particularly for businesses operating in multiple countries. A professional outsourcing partner will help you stay compliant while optimizing your tax position.

- Compliance Expertise: Experienced teams that can manage tax reporting for multiple countries, reducing the risk of errors or penalties.

- Tax Optimization: They help identify tax-saving opportunities to minimize liabilities legally.

- International Taxation Knowledge: They navigate global tax complexities efficiently, including GST, transfer pricing, and withholding tax.

- Proactive Accuracy: They ensure your books remain accurate and compliant by catching issues early and making audits and reporting flawless.

Ultimate Finance Process Outsourcing

Modern bookkeeping goes beyond recording transactions—it involves managing the entire financial workflow. You should get:

- Complete Services: Partners that can handle accounts payable, receivable, payroll, reconciliations, and financial reporting by covering all critical processes.

- Efficient Processes: Smooth workflows from transaction entry to final reporting to reduce errors, save time, and boost overall efficiency.

- Actionable Insights: Integrating financial analytics into bookkeeping helps you make informed business decisions.

Chartered Accountants and Technology

The combination of professional expertise and technology is a game-changer for global bookkeeping. Your bookkeeping service should include:

- Expert CA Guidance: Experienced Chartered Accountants offering strategic insights alongside daily bookkeeping.

- Advanced Software: Use of tools like QuickBooks and Tally to ensure accurate and organized financial records.

- Cloud Access: Cloud-based systems allow you to access financial data anytime, anywhere, keeping you in control without constant supervision.

Data Security and Confidentiality

Ensure that they keep your financial data secured, because financial data is very sensitive and security cannot be compromised.

- A trusted partner follows international data protection laws for protecting your information.

- Encryption, secure servers, and firewalls protect your data from cyber threats.

- Clear agreements and strict internal procedures prevent unauthorized access.

- Security audits and data backups ensure that your data remains safe, accurate, and accessible even in emergencies.

Final Thoughts

As global businesses continue to look for smarter ways to manage their financial functions, professional bookkeeping outsourcing in India has clearly emerged as a dependable and strategic solution.

With its strong talent pool, advanced technological capabilities, cost efficiency, and deep understanding of global accounting standards, India offers more than basic support—it delivers long-term value and financial clarity.

Outsourced bookkeeping services in India offer the flexibility, accuracy, and expertise you need.

For US-based companies especially, offshore bookkeeping services in India for US firms enable flawless operations and reliable oversight without the challenges of in-house hiring or rising operational costs.

Choosing the right outsourcing partner means gaining a team that works as an extension of your business by protecting your data, improving your processes, and ensuring that every financial decision is backed by accurate, real-time insights.